What is it ?

- Zero cost collar – Buy an out of money put and sell an out of money call. Cost of put will be covered by sale of call therefore zero cost.

- Zero cost collar = synthetic long call-spread + long underlying.

How is it constructed ?

- Investor uses the premium received from sale of a call to finance the purchase of a put at higher strike. This strategy is combined to give a structure whose payoff resembles thet of long call-spread.

What is the payoff ?

Max profit : K call – So

Max Loss : K put – S0

When is it used ?

- Used when an investor does not expect the underlying to rise above the call strike level and would also like the reduce risk below the put strike level.

- Used especially by institutional investors who wish to lock in profit they already gain on underlying.

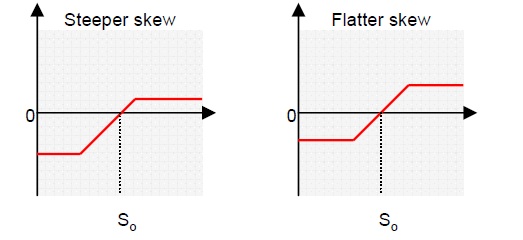

- Used when skew is relatively flat, thus implied volatility on call. Thus price for put is cheap relative to premium gained for call. Since investor buys a put and sell a call, such cheapness allows the investor to buy a relatively less-out-of-the-money-put, thus the zero cost position will shift down along the structure allowing more potential upside participation for a given level of protection.

What are the benefits ?

- Maximum loss is limited to the difference between current spot price and put strike level.

- No cost is involved in the hedging, in exchange for also capping maximum gain.

- Locking in of gains already made on underlying by setting an appropriate put and call strike level. This allows investors to secure their gains on a given underlying once they have beaten a certain benchmark.